Need Help Understanding Insurance Terms?

How Students Can Protect Personal Belongings At School

Moving into college is an exciting time for many students, especially for those that are moving far away from home for the first time. Planning for the upcoming school year can be fun as you go through checklists and dorm/apartment essentials, contacting roommates, and discovering that, yes, some stuff won’t fit in the car when packing. Often students never consider what would happen if all their new property such as tech and textbooks were damaged or stolen. Extra stress over losing and trying to replace items is the last thing that students need while trying to maintain grades, work, and a social life. Thanks to renters’ insurance students don’t have to worry as their property will be protected, and for even better news, it’s far more affordable and less complicated than it sounds!

Renters Insurance Explained

Similar to other types of insurance, renters insurance offers financial security in the event of unexpected, costly damages or losses. Renters insurance protects personal belongings while a landlord’s insurance usually only covers the building, not individual tenants’ property. The same goes for school-owned buildings such as residence halls and other on-campus dorms/apartments. So if the person down the hall has a kitchen incident that causes sprinklers to go off, your textbooks, laptop, and other expensive items could be ruined but at no fault of your own. Renters insurance would help you to replace these items.

Travis Biggert, chief sales officer for the Mid-America region of HUB International, the nation’s largest, privately-held insurance brokerage, points out that property replacement isn’t the only benefit of having renters insurance. “It protects your stuff, but, as importantly, it protects you against liability you may unknowingly assume.” This means that if someone gets hurt in your dorm, your unit receives damage, or an accident in your apartment cause damage to your neighbor’s place, you have coverage.

Also, renters insurance covers more than just damaged or stolen property: Renters insurance can provide coverage that aids in additional living expenses in certain circumstances. Some policies include reimbursement toward losses incurred in an identity theft case.

A 2016 poll found that only 41 percent of renters have renters insurance. People often assume that renters insurance is too expensive for things not worth that much. But consider this: The average cost of a new college textbook was $80 in the 2015-16 school year. According to the National Association of Insurance Commissioners, the average renter’s insurance premium is between $15 and $30 each month. Even if a dorm has very little in it but books for school, that student’s premium would cost less than the out-of-pocket replacement costs for those books if they were to be stolen or damaged. Renters insurance policies usually cover property items such as electronics, household appliances, clothing, or jewelry, which can add up quickly if a catastrophe happens.

What Does Renters Insurance Cover?

Basic renters insurance policies usually give college students coverage in these three main areas:

Personal Property-

Renters insurance coverage includes the cost of personal belongings that are stolen or damaged in a covered natural disaster or other similar events. The types of perils renters insurance covers may vary from policy to policy but commonly include damage caused by fire, smoke, vehicles that don’t belong to the renter, lightning, wind, heating and cooling systems, civil commotions, vandalism, hail, sleet, snow, ice, falling objects, volcanic eruptions, and several others. This may seem like a lot, but remember that not all insurance policies cover all these perils. Agencies should consider where the student lives when creating policies to determine if their client’s renter’s insurance is sufficient for their situation. As an example, a student renting a house in North Dakota may want to add coverage to damage caused by the weight of snow or ice while a student in California would rather get coverage for earthquakes or wildfires.

Renters insurance also covers borrowed or rented items, so if a fire damages a camera borrowed from the art department, the student renter can relax. Renters’ insurance also protects items that are stolen or damaged outside of the rental unit – in their vehicle, for instance.

Liability-

What people often don’t realize is that renter’s insurance can also cover legal costs if the owners of the rental building decide to sue you (and possibly your parents) for the cost it took to repair damages caused to the building and even the loss of rents from those tenants that moved out during reconstruction. Hypothetically if a fire starts in your apartment and a neighbor on another floor suffers injuries during the fire, they are obligated to sue you. The liability coverage of a renter’s policy will cover legal costs up to the limits of the policy.

Additional Living Expenses-

If an accident does happen that keeps a student from residing in the dorm or apartment while repairs take place, that student’s policy may provide living expenses like meals and temporary housing. Deciding where to live and how to pay for it while studying for midterms is something most students are likely trying to avoid.

It is also just as important to learn the things that renter’s insurance doesn’t cover. Insurers often limit protections offered in known earthquake and flood zones because of their inherent risks. Also, pricey items like jewelry and electronics are usually subject to individual coverage limits. However, add-on policies may be purchased to provide extra protection in specific areas a basic policy may not include.

Another important aspect is to know is what exactly an insurance company’s theft protection offers. Theft, which usually comes with a sign of forced entry, is covered but ‘mysterious disappearances’ usually are not. There is a separate type of policy, called a personal articles floater, that pays when one of your valuables is just ‘gone.’ For example, someone who wears an expensive earring into the ocean but then swims out to discover it’s gone. That’s not theft because nobody broke into your home and stole it; it’s just mysterious disappearance. Ask about these things, so you don’t learn the hard way once your valuable is gone.

When Do College Students Need Renters Insurance?

The most important insurance for students living off-campus and away from home is Renters insurance. Students who aren’t protected under their parents’ insurance should get their own policies. Even if students are covered under their parents’ policies, their acceptable claim amounts may be limited to a small percentage of the coverage amounts extended to their parents, so students’ coverage may not fully protect the value of their things, they should make sure that the amount of protection that extends to them through their parents’ policies covers the cost of their belongings.

Most parents’ policies only offer a small percentage of the overall coverage, often 10 percent, to students living away from home. If the parents’ homeowners insurance policy provides $100,000 of coverage, their student could only receive up to $10,000 from a claim. Students who are covered by their parents but plan on bringing highly valuable items to school should have enough coverage, and, if not, they should either get their own policies or look into purchasing floaters or riders for specific items.

Some policies have what is called place value caps on certain types of items, like electronics. A student whose electronics are worth more than his or her policy coverage should consider a policy more suited to that item or consider adding a floater.

All students should look carefully into their renters insurance policies or, if applicable, their parents’ policies to make sure they have the proper coverage. Policies differ greatly, and, depending on restrictions, caps, deductibles, and other fine-print stipulations, it may be more practical for students to get their own rental insurance policies. Students and their parents should also speak to an agent to determine the best option for their needs.

When Don’t College Students Need Renters Insurance?

Sometimes there are situations in which paying for renters insurance may not make sense. For example, students who commute from home will not need renters insurance because they are already covered under their parents’ insurance policies as they live at the same residence.

This also will often relate to students who live on campus in dorms or other school-affiliated housing, as they may still have coverage under their parents’ homeowners insurance policies. It’s important for students and their families to check the details of their existing insurance policies to ensure proper coverage can be provided. If students don’t need renters insurance, it might be good to get insurance endorsements for specific items that reach beyond policy limits.

Finally, anyone living in a temporary housing situation — for instance, crashing on a friend’s couch, in an Airbnb rental or in a hotel room — is not eligible for renters insurance. The host is usually responsible for obtaining short-term insurance for these situations, and some insurers sell specialized short-term policies to guests in the rental residence.

Shopping Around for Coverage

Searching for a renters insurance policy that fits you can take time and research. Talking with a range of providers and comparing policies helps customers make sure they get the right coverage for themselves. Take advantage of free quotes as a cheap and easy way to make some policy comparisons.

“I recommend an independent insurance agent,” Biggert says, “because they have access to numerous insurance carriers and can give you an idea of who has the best pricing and terms in the specific area where you live.”

Students should also check to see if they completely understand their policy coverage because not all renter’s insurance coverage is the same. Ask about exclusions and limits, and find out whether add-ons are needed for your specific items. Considering the total value of a policy rather than just the premium can help students make more correct comparisons between different renters insurance policies. Students should also think about their practical needs to avoid paying extra for coverage they don’t need.

So how much coverage do you need? To calculate the correct amount of coverage, take a detailed inventory of everything the student plans to take to school. Laptops, clothes, textbooks, and furniture add up quickly. This inventory also eases the process of filing a claim should an incident occur. During this stressful moment in families’ lives, lowering as much stress as possible in cases of loss is always a plus. Keep a copy of the list in a safe place, like saved in the cloud or in a safe deposit box, and update it regularly.

Also, ask agents about how much liability coverage is included in their policies. A personal liability limit of at least $500,000 is recommended.

Insurance companies may offer discounts when bundling their renter’s and auto insurance. Students also can talk to their insurance agents about how else to save money, such as discounts available through affiliations with schools or employers. Parents who are members of alumni associations might be able to receive deals, too. Reducing risk of theft and damage to an apartment can also earn students some discounts, although it may require collaboration with landlords. Installing deadbolt locks, security systems, new smoke detectors or fire extinguishers lessen the risk of theft or damage, so insurance companies may offer discounts to students who take these precautionary measures.

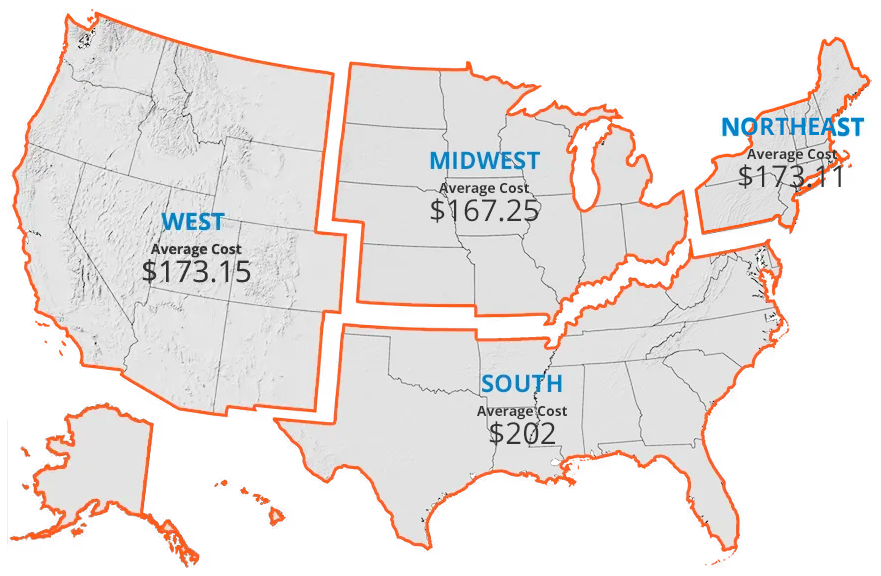

If savings aren’t significant right away, students can get new quotes every few years to lower their rates. An improved credit score and a claim-free record yield a better premium down the road. On average, though, renters insurance is pretty affordable. The following table breaks down the average premium for renters insurance by region.

Other Factors to Consider

Students should take into account several other factors before making a final decision about their insurance.

Deductibles, for instance, can greatly affect a student’s decision. Deductibles can often be lowered, but it means having to pay a higher premium. Do some calculating to figure out whether saving on the premium is worth a higher deductible in case of damage or less. Taking $10 off your premium might seem nice, but if it means having to pay $1,000 out of pocket to replace losses in a claim instead of $500, that $10 a month saved may seem insignificant. A deductible should be an amount a student can have readily available in case of an emergency. Keeping it in a savings account or a safe deposit box along with the inventory list is a good idea.

“Always get a ‘replacement cost valuation’ endorsement when it comes to property losses,” Biggert adds. “Use that exact term. The insurance agent will know what it is, and you’ll be glad you did if you ever have a claim.”

A policy with a replacement cost valuation covers the cost of replacing a given item at its actual cost, rather than at its estimated value, which factors in depreciation.

Students should also take into account their locations and whether they plan to have roommates or pets. If a student needs to keep some belongings in a storage unit, that student should determine whether those items would be protected. These variables change policies and should be discussed with an agent.

Coverage limits should also be considered. Renters insurance policies have overall limits for personal property, liability and additional living expenses as well as limits within certain categories, like electronics. If a policy meets a student’s needs in terms of personal property protection but is lacking in liability coverage, that student could be in hot water if someone gets hurt in his or her apartment and decides to sue. Similarly, a policy could look great at first, but maybe its coverage for electronics loss is limited. If most of a student’s valuables are electronics and the policy only covers $1,000 in electronics with a $200 deductible, it may not be the best option. Getting insurance for specific items, such as phones, laptops, TVs, and gaming consoles, can be a nice alternative to a more extensive renters insurance plan. Many of these big-ticket items also are sold with the option to add insurance or replacement protection at the time of purchase.